17. Forms of commercial vessel charter, evaluation of the right–of–use and the charter market rate

The value estimation of the commercial vessel, other real asset of the marine company or the property complex right–of–use has a close relation to value estimation of the property rights: possession, disposal and use and to application of the income approach for market value determination.

The various combinations of conditions of commercial vessel or other asset of the marine company rent (freight) which differ by the set of transferred rights can be applied and the value of the charter market rate corresponding to the value of right–of–use depends on the kind of renting contract.

There are different types of commercial vessel charters: the bare boat charter, the demise charter when the tenant (renter) should besides the payment of rent charges for the owner, bear also the operation costs connected with commercial vessel productive operation and expenses for maintenance, repair, insurance, management of operation and all other operational expenses.

Besides, for a shorter interval of use, smaller than the technological period of the maintenance servicing of the commercial vessel, the contract can consist of a time charter rent when the equipped vessel is transferred into the tenant’s operation and the obligations of vessel maintenance lay with the ship–owner. Thus the tenant should not supply, repair, manage operation, etc. the vessel.

For example, the following items can be transferred to a tenant for short time interval of use: the vessel charged and served by the crew, the working equipment served by workers, the premises with service and etc. In some cases the obligation of property servicing can remain on the proprietor, as well as in case of long term renting if servicing concerns the joint use of the property, for example, in case of renting of separate premises.

Besides, the commercial vessel can be rented with the redemption by the leasing contract which can be applied as the economic analogue of crediting with the commercial vessel as a security of the debt if instead of pledge obligations the borrower sells his own vessel to the leasing company and rents the same vessel with the condition of redemption of the last one at the end of the period of use.

When estimating of the rights of the commercial vessel rent contract it is necessary to adhere to certain recommendations concerning terms the «right–of–rent» and «right–of–use». It is the right–of–use which is transferred instead of the right–of–rent.

The right–of–rent that is the right to conclude the rent contract naturally is available for each capable person and is free. The right–of–rent is not estimated. The right–of–rent is not exclusive. The right of each person (physical or legal) to lease vessel that is the right of the person to conclude the rent contract is not a negation of this right of the other person.

The property rights – possession, disposal and following from the rent contract the right–of–use, – are exclusive as the necessary assumption of value and the right of any person to use an asset excludes this right from another person (according to the civil law).

It is required to pay for the rights which follow from the contract of rent. And the right–of–use which is provided under Article 209 of the Civil code of the Russian Federation (and the right–of–rent is not provided) follows for the tenant.

It is the right–of–use of commercial vessel under the contract of rent which is subject for estimation instead of the right–of–rent if we are about primary access to the right–of–rent that usually is not a subject of estimation.

The determination of the charter market rate value can correspond to estimation of the right–of–use of the contract of rent for various provisions:

– Only to the value of the right–of–use, if obligations for vessel maintenance (or other asset of the marine company) lay on the tenant by the contract of rent during the period of use;

– To the sum of the right–of–use value and the present value of obligations flowing for vessel maintenance if service obligations lay with the owner instead of on the tenant;

– To the value of the sum of the right of commercial vessel use by the leasing contract (rent with the repayment) and property right present value at the end of the period of use that is on the day of carrying out the pledge with the repayment performance etc.

Test questions

1. Estimation of property rights set and the part of property rights.

2. Types of commercial vessel charter (freight).

3. Property right following from the contract of rent.

4. Leasing – commercial vessel transfer for use with the repayment, the analogy of commercial vessel leasing and the pledge crediting.

17.1. Right of use estimation as a difference of the vessel present values at the beginning and at the end of the period of use

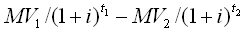

The value of the right of commercial vessel use transferred in rent should be defined as difference of present values of market value MV at the beginning t1 and at the end of t2 of the period of use.

And the market value at the beginning of the period of use and at the end characterizes in aggregate the right of possession, disposal and use and should be estimated by standard approaches.

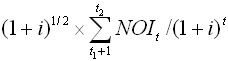

The other, logical, at first sight, possibility of the right–of–use evaluation as a capitalized sum of the discounted cash flow of net operating income NOI t for the interval t1, t2 time of use

it is not quite exact methodologically as, when determining the value by the application of standard approaches set is not covered: the comparable sales, the income and the costs.

The same remark concerns the application of separately taken approaches for right–of–use evaluation: the comparable sales approach (by the data of estimations of analogues use) or the cost approach (by calculation of all expenses total connected with use, including taxes, specific payments, and also with the account the profit estimated by a certain rate).

In some sets of the circumstances the supposed methodological contradictions in process of estimation can be results of concepts confusion. For example, it is known, that in some cases the task of asset estimation based on income approach is based on use of the charter rate index that can intuitively be perceived as similar tasks of the value estimation of the right of asset use and the estimation of asset market value based on income approach.

The contradiction can arise, if, on the one hand, it is required to estimate the charter market rate, and on the other hand, the base of an estimation from systematic point is the market value depending on which the value of the right–of–use and further the charter market rate is determined, and there is a mistaken impression that the charter market rate is both the initial data and the result of estimation.

It should be noted, that the similar confusion in case of an insufficient professional experience of the expert is not only a feature of tasks of the value estimation of the right–of–use and the charter market rate, it concerns any value estimation. The same erroneous impression about the contradiction of data and results can arise in case of estimation of the market value by the independent approaches, as among the data of the comparable sales approach the market values concerning analogues are used.

In general, among professional qualities of experts ability to distinguish initial data from results is great importance; it demands knowledge of applied economic estimation methodology including understanding the relationships of cause and effect, the subject, the object and the method.

The object of estimation is a set of property rights. The subject is the purpose and the assignment of estimation that is a type and purpose of the determined value.

At the initial stage of market reforms in Russia (in the 90-s of the XX century) when the professional expert estimation was being formed and methodology it was not sufficiently finished, and some times there was the mixing of methodological concepts and sometimes it had a regular character.

For example, in the course of mass revaluation of the real assets in the second half of 1990–s the balance cost of assets which was reflected in the financial and tax records was estimated. As the methodology of the real assets revaluation did not provide expert determination of depreciation the estimation of reproduction cost was made which corresponds to the sum of market expenses for reproduction of the real assets.

It is possible to guess that for subject simplification usually appraisers determined the reproduction cost on the basis of the expenses summation concept though the comparative approach was often used too but the income approach was not applied for estimating the reproduction cost, as there was no sufficient understanding, that market expenses in the sum should be paid back, that is, they can be determined based on income approach too.

It cam be to explain by an abstract example: if commercial vessel displacement is equal to the total weight of all her parts, not necessarily the method of displacement determination consists in summation of weight parts and it is possible to determine the weight of the superseded water, that by the Archimedes law is correct determination of displacement.

Coming back to contradictions of the enterprises property revaluation in 1990–s, it should be noted, that in case of reproduction cost calculation (together with other types of value, methodologically and algorithmically truly defined through the market value concept as a base of valuation) the appraisal standards should have been followed and if there was such possibility, and in many cases such possibility was, standard independent approaches should have been applied for reproduction cost estimation, including the income approach, instead of to confuse the subject and the method – the concept of reproduction cost as the market expenses total and the method of estimation on the basis of expenses summation.

Note, that the specified methodological contradiction and mixing of the subject of revaluation and the method had a negative influence on the appraisal as with great demand there was a limited range of offered expert services which were incomplete and low quality (in sense of insufficient conformity to appraisal standards), and also extensive style of some appraisers job with customers was generated – an aspiration «to take a bite of all apples» (including the desire to have the whole staff but be unable to make it qualitatively) that negatively influences the appraisal indexes today in lack of demand.

On the other hand, as the purpose of applied expert activity in the economy is assistance for the financial assets advancement in the real sector the specified tasks of the economic estimation which reasons originate in insufficient methodological finishing can also make negative impact on the real economic sector.

To complete the professional profile of experts dealing with value estimation in applied economic, besides the examples showing erroneous mixing of cause and effect (that is the data and the results), the subject (that is the value concepts) and the method, it is necessary to pay attention on necessary experts abilities to distinguish the objective methodology in the applied economics from the conventionalities and to understand the primacy of methodology.

The area of regulation by standards in an economic estimation usually corresponds to the extent of generalization at the level of approaches, and detailed elaboration of approaches to the level of methods is done by experts independently on the basis of professional methodology application which is rather extensive and improved.

The vocational training of the expert is insufficient, if, for example, he just has a task of present value estimation by the discount financial functions, and there is a question whom the standard of these formulas is accepted and approved, by which, of course, were not accepted by the standard and grew out of the formal logic.

By the way, any objective laws and not only in applied economics have no standard status, for example, it is not required the approval of any parliament for the law of universal gravitation or for any other materialistic law.

In each case more detailed analysis usually shows that an obstacle for the expert is an insufficient own professional experience taking into account the level of considered task and applied methodology complexity rather than the absence of the standard status of the methodological appendices. Thus the absence of the regulating standard is not a difficulty for the expert if the level and methodological complexity of the task correspond to his qualification.

If the expert is not capable to develop and to apply within the limits of independent approaches the objective estimation methods independently he searches for instructions and standards which for specified conditions don’t exist and will not exist and, finally, he can wrongly apply an inadequate method.

The vocational training of experts who are responsible for working out standards for experts in the field of applied economics is of great importance. On the one hand, the standards for experts should not regulate particular and they should have a universal character. On the other hand, conformity of these standards to the formal logic of economic valuation is required instead of to instruct the experts on conventions which have nothing in common with formal logic.

The right of use is evaluated with systematic approach, and methodological concepts and standard rules are observed if to adhere to the concept of market value as a base of estimation of a set of the property rights: possession, disposal and use, – and if to estimate other kinds of value through market value, including to define the value of the separate right from set – the right–of–use, that is concerning the value at the beginning MV1 and at the end MV2 of the period of use and concerning market macroeconomic index of total risks according to the discounting rate i the present value of the right–of–use from the systematic approach point of view can be evaluated as a difference of present values: the market value at the beginning and at the end of the period of use  .

.

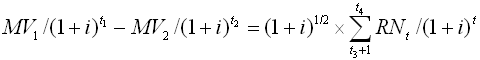

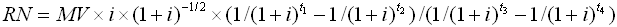

From the systematic point of view to determine rent charges cash flow

RNt the present value of the right–of–use should be equal the present value of rent charges cash flow.

The estimation of rent charges cash flow

RNt is determined by solving the equation

, , |

(17.1) |

where

t3,

t4 – the beginning and the end of rent charges payment interval.

Charter market rate

RN means a rent charge of the equal value and uniform periodicity, which present value corresponds to the value of the right–of–use of commercial vessel (or other asset of the marine company).

The value of charter market rate

RN or cash flow of the rent charges

RNt corresponding to the value of the right–of–use by the condition (17.1can be determined by selection in Excel tables.

The payments by the rent contract generally can be fulfilled by the advance payment at the beginning of each payment period or by installments – credited vessel use with payment at the end of the payment period.

It is unessential, if the time interval of rent charges payment (that is the beginning

t3 and the end

t4 of the interval) coincides with interval of vessel use (the beginning

t1 and the end

t2).

To estimate the right of use there should be a coincidence of the time reference points, coincidence of time of estimation of both the market value of the commercial vessel and rent charges cash flow, that is conformity of the time of estimation.

And the concept of the appraisal time means any moment at which both present values are estimated, the values of the rights and obligations concerning vessel use (or other asset of the marine company) by the rent contract and the value of the tenant obligations, for example, present value of payments cash flow, that is, the appraisal time is any day at which present values of all commercial vessel rent indexes are determined.

In particular, the uniform appraisal time for estimation of all present value indexes of the contract of rent can be the time of the beginning

t1or the end

t2 of an interval of use, the time of the beginning

t3 or the end

t4 of rent charges payment interval.

But the best way is define the day when the contract of rent was made as an appraisal time at which all present values are determined, for example, combined with the beginning of use

t1 or the beginning of rent charges payment

t3 from which the indexes are counted in years

t1,

t2,

t3,

t4. And are applied not only the whole numbers are applied, but fractional values and also zero in case of coincidence to the time of settlement.

Test questions

1. Evaluation of the right–of–use of the vessel as difference between the present market value at the beginning and at the end of interval of use (the formula derivation).

2. Unilateral character of the right–of–use estimation by the methods of the income approach or other approaches separately.

3. Confusion in case of concepts mixing of kinds of the value and the methodological approaches applied to evaluation.

4. Reproduction cost with the account payback of a new asset of the marine company.

5. Systematic approach in case of estimation of various kinds of value through market value, as a base of estimation.

6. Conformity of standards to the formal logic of applied economic estimation.

7. Value of the right–of–use estimated as difference of asset present value at the beginning and at the end of the use term in the prices of time of settlement.

8. Rent charges cash flow and the charter market rate.

9. Concept of the present time in case of the right–of–use evaluation.

17.2. Calculation of the charter market rate on the basis of equality of rent charges flow present value and the right of vessel use present value

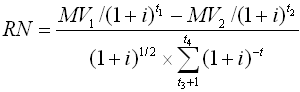

The value of annual charter market rate RN when the value of the right of commercial vessel (or other asset of the marine company) use is equal to the present value of rent charges cash flow, is:

. .

|

(17.2) |

The values at the beginning

MV1 and at the end

MV2 of the period of use in applied tasks have the forecasting character and the value at the end of the period of use

MV2 is more unclear as the predicted value at the end of the period of use is more distant in time from the settlement day.

If the vessel value (or other asset of the marine company) can change essentially during the period of use, the vessel (or an asset) shouldn’t have been transferred in use but sold.

In case of value estimation of the right of vessel use, as methodological precondition, it can be assumed that the value varies a little during the period of use that is

MV1=

MV2=

MV.

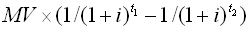

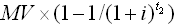

Then value of the right–of–use is approximately equal

. This assumption is more obvious for durable assets, for example, for real estate.

With the account an assumption about minor alteration of the vessel value during the period of use (for example, year), having connected time readout with the beginning of the period of use (

t1=0), the value of the right–of–use depending on the base market value

MV can be estimated approximately as

.

The interval of rent charges (the beginning of interval

t3 and the end

t4) fractioned to the periods.

The determination of the charter market rate value in relation to a calendar periodicity of payments – to a year, a half a year, a quarter, a month, a week, a day is of interest. And the recommendations for value estimation of the right–of–use and charter market rate

RN concerning the general meaning of the set interval of the period of use (the beginning of period

t1and the end

t2) and interval of rent charges (the beginning of interval

t3 and the end

t4) are considered above (17.1, 17.2).

The value of annual charter market rate

RN corresponding to the value of the right–of–use depending on the little varying market value of the vessel

MV, when sousing the discount financial functions, is equal:

, ,

|

(17.3) |

and if the beginning and the end of the period of use, on the one hand, both the beginning and the end of an interval of rent charges, on the other hand, accordingly coincide that is if

t1=

t3, and

t2=

t4, the formula for estimation of the annual charter market rate for the advance payment

RN paid at the beginning of each year is:

| . RN=(1+i)-1/2×MV×i |

(17.4) |

The value of annual charter market rate

RN of the payment paid by installments at the end of the year is determined as

The value of the charter market rate of advance half-yearly payment

RN(½), paid at the beginning every half a year is equal:

RN(1/2)=(1+i)-1/2×MV×i/(1+1/(1+i)1/2). |

(17.6) |

The value of the charter market rate of half-yearly payment

RN(½) paid by installments at the end of every half a year is determined as:

RN(1/2)=MV×i/(1+1/(1+i)1/2. |

(17.7) |

The value of the charter market rate of advance quarterly payment (that is for ¼ part of year)

RN(¼), paid at the beginning of each quarter, is determined as:

RN(¼)=

(1

+i)-1/2×MV×i/(1+1/

(1

+i)1/4 +1/

(1

+i)1/2 +1/

(1

+i)3/4), or after derivation by the geometrical progression sum it is possible to receive the formula

. .

|

(17.8) |

The value of the charter market rate of the advance payment which is done at the beginning of the payment period for any duration of the period (

t/365 – part of the year, where the time index

t is set in days) is equal:

. .

|

(17.9) |

The value of the charter market rate of the payment by installments which is done at the end of the payment period for any duration of the period is determined as

. . |

(17.10) |

The value of the charter market rate of quarterly payment

RN(?) paid by installments at the end of each quarter is equal

. .

|

(17.11) |

The value of the charter market rate of advance monthly payment

RN(1/12) that is the 1/12 part of the year paid at the beginning of each month is

. .

|

(17.12) |

The value of the charter market rate of monthly payment

RN(1/12) paid by installments at the end of each month is determined as

. .

|

(17.13) |

The value of the charter market rate of the advance payment

RN(7/365) paid at the beginning every week (that is 7/365 parts of year) makes

. .

|

(17.14) |

The value of the charter market rate of payment

RN(7/365) paid by installments at the end of every week is determined as:

. .

|

(17.15) |

The value of the charter market rate of

RN(1/365) advance daily payment or by installments (the specified condition in this case is insignificant in view of close conformity of the result in case of moderate risks) is equal

. .

|

(17.16) |

It should be noted that the present value of rent charges cash flow in case of weekly transfer (or daily transfer) practically does not depend on, whether transfer is made by advance payment at the beginning of each payment period or by installments – at the end of the period.

The similarity of present values of advance payment and payment by installments is mathematical property of cash flow summation in case of reduction of the payment period duration.

When defining the charter market rate value and the present value of rent charges cash flow the discount financial functions (17) based on estimation of reinvestment are applied. At the same time it should be taken into consideration, that the reinvestment and accumulation for the discount financial functions is characteristic at enough big duration of payments intervals.

Apparently, for the short payments intervals the present value of rent charges cash flow is subject to estimation on the basis of arithmetic summation instead of by discount financial functions, as the resultants of present value for both variants of summation at moderate risks practically do not differ. It is fair if investors do not possess continuous access to stock exchange market.

The value of the charter market rate with daily payment by equal parts excluding the reinvestment payments with the account the small duration of the payment period is equal

, or

. .

|

(17.17) |

By the formula (17.17) of the charter market rate value per day is determined on the basis of the charter market rate in week estimation (with use of discount financial functions – 17.14 or 17.15) and the subsequent division of the payment into seven days.

Besides, in order to determine of the charter market rate per week

RN(7/365) depending on the market value

MV of the commercial vessel (or other asset of the marine company) and on interest rate (discounting rates

i) the formulas 17.12 and 17.13 can be used instead of formulas 17.14 and 17.15 – for determination of the charter market rate payment

RN(1/12) per month and the subsequent arithmetic division of result into number of weeks in month

365/(12

×7)≈ 4,345.

The value of the charter market rate per week

RN(7/365) depending on the charter market rate per month

RN(1/12) is equal

.

The formulas (17.4–17.17) are applicable for estimation of the right–of–use value and the charter market rate in case of:

– Use of market value concept as bases of estimation;

– Assumption of constant market value during the period of vessel use;

– Task that the vessel maintenance is the tenant’s obligation instead of the proprietor’s one;

– Conformity of intervals periodicity of payments as the preconditions of formulas (17.4–17.17);

– Assumption of uniform periodicity and uniformity of the charter market rate payments value.

Test questions

1. Equality of the right–of–use value to the present value of rent charges cash flow.

2. Value estimation of the right–of–use in the assumption of market value invariance during the interval of use (the formula derivation).

3. Value of annual rent charge corresponding to the value of the right–of–use in case of little varying of the commercial vessel market value (the formulas based on account of the value, the discounting rate and the period of use).

4. Preconditions of formulas applicability and practical recommendations for evaluation of the right–of–use with the assumption of unchangeable asset value during the period of use.

17.3. Estimation of the adjustment to the charter market rate taking into account predictable change of the vessel value by the end of the period of use

If the value an asset of the marine company predictably varies during the period of use, for example, it decreases in process of expenditure of a certain resource or grows in process of accumulation, that is, if  ≠

≠ , the value of the right–of–use is accordingly equal

, the value of the right–of–use is accordingly equal

,

,

and to determine the value of the charter market rate RN the adjustment to the values received above (17.4–17.17) should be applied.

If to designate the value at the beginning of the period of use  =MV, then, with the account used designation, the value of the right–of–use

=MV, then, with the account used designation, the value of the right–of–use  should be determined with adjustment

should be determined with adjustment  , that is

, that is

With the account the change (depreciation) of the value

by the end

of the period of use the adjustment to the value of the right–of–use is equal

, or

– the second component in the resultant mathematical equation.

The value of the annual charter market rate

with the account the reduction

of the value by the end

of the period of use should be determined with application of adjustment

to the value of the charter market rate

RN calculated by formulas (17.4–17.17) with the assumption that the value during the period of use did not vary.

And if the value by the end

of the period of use increases the index

is of negative value.

With the account the reduction

of the value by the end

of the period of use the value of the charter market rate in the sum with the adjustment is determined as:

. .

|

(17.18) |

The adjustment

to the estimated annual charter market rate

RN determined by the formula (17.3) with the account the reduction

of the value by the end

of the period of use is equal

, ,

|

(17.19) |

and if the beginning and the end of the period of use, on the one hand, both the beginning and the end of the period of rent charges, on the other hand, accordingly coincide, and if the beginning of the period of use coincides with the time of settlement, that is

=

= 0, and

=

, the adjustment

to the value of annual charter market rate

RN of the advance payment paid at the beginning of the year determined by the formula (17.4) is

or or  , ,

|

(17.20) |

where

– is the factor of the fund of compensation of the depreciated part of investments by the end

of the period of use adhered to the value reduction

.

The general recommendation applied to determine the adjustment

to the charter market rate

RN calculated for calendar periodicity of rent charges by each of formulas (17.4–17.17) with assumption, that the value

MV does not vary by the end of the period of use is that if to make a replacement of symbols:

for

, or

MV for

, the result will be a corresponding adjustment

to the charter rate with the account the reduction

of the value by the end

of the period of use, but not the charter market rate

RN.

The adjustment

to the value of annual charter market rate

RN of the payment paid by installments at the end of year determined by the formula (17.5) is equal

, or , or  . . |

(17.21) |

The adjustment

to the value of the charter market rate of advance payment

RN(½), determined by the formula (17.6) paid at the beginning every half a year taking into account the reduction

of the value at the end of the period of use is

. .

|

(17.22) |

The adjustment

to the value of the charter market rate of payment

RN(½) determined by the formula (17.7) paid by installments at the end of every half a year taking into account the reduction

of the value at the end of the period of use is equal

. .

|

(17.23) |

The adjustment

to the value of the charter market rate of advance quarterly payment

RN(¼), determined by the formula (17.8) paid at the beginning of each quarter (that is ¼ part of year), taking into account the reduction

of the value at the end of the period of use is

. .

|

(17.24) |

The adjustment

to the value of the charter market rate

RN(

t) of the advance payment determined by the formula (17.9) which is done at the beginning of the payment period for any duration of the period (the

t/365 part of the year where the indicator

t is set in days) taking into account the reduction

of the value at the end of the period of use is equal

. .

|

(17.25) |

The adjustment

to the value of the charter market rate

RN(

t) of the payment by installments determined by the formula (17.10) which is done at the end of the payment period (for any duration of the period), taking into account the reduction

of the value at the end of the period of use is determined as:

. .

|

(17.26) |

The adjustment

to the value of the charter market rate

RN(¼) the payment paid by installments at the end of each quarter, taking into account the reduction

of the value at the end of the period of use is equal

. .

|

(17.27) |

The adjustment

to the value of the charter market rate of the advance payment

RN (1/12) paid at the beginning of each month determined by the formula (17.12) taking into account the reduction

of the value at the end of the period of use is

. .

|

(17.28) |

The adjustment

to the value of the charter market rate of payment

RN(1/12) determined by the formula (17.13) paid by installments at the end of each month, taking into account the reduction

of the value at the end of the period of use is equal

. .

|

(17.29) |

The adjustment

to the value of the charter market rate of the advance payment

RN (7/365) paid at the beginning of every week (that is 7/365 parts of year) determined by the formula (17.14) taking into account the reduction

of the value at the end of the period of use is

. .

|

(17.30) |

The adjustment

to the value of the charter market rate of payment

RN(7/365) determined by the formula (17.15) paid by installments at the end of every week taking into account the reduction

of the value at the end of the period of use is equal

. .

|

(17.31) |

The adjustment

to determined by formulas (17.16, 17.17) of the value of the charter market rate a day

RN(1/365) taking into account the reduction

of the value at the end of the period of use is

. .

|

(17.32) |

It should be noted that adjustment

, determined by the formulas (17.19–17.32) is applied in the formula (17.18) to the charter market rate with the account the predicted reduction

of the value by the end

of the period of use which can be estimated.

If the reduction adjustment

of the value by the end

of the period of use can’t be predicted the unpredictable variability of value should be considered as an additional risk factor and it should be taken into account as a part of the discounting rate

i.

In this case market rate

RN should be estimated by the formulas (17.4–17.17) derived at an assumption that the value

MV does not vary by the end of the period of use instead of the adjustment determination

to the charter market rate by formulas (17.19–17.32), but unpredictable variability of the value by the end

of the period of use should be considered as an additional risk factor and a component of the discounting rate

i.

Test questions

1. Value of the right–of–use in case of the predicted change of the asset value of the marine company or the property complex during the period of use.

2. Adjustment to the estimated value of the right–of–use estimation with the account the change (depreciation) of the asset value at the end of the period of use.

3. Estimation of the right–of–use in case of unpredictable variability of the value during the period of use.

17.4. Calculation of the adjustment to the charter market rate in view of ship–owner’s obligations for charges and maintenance

If the obligations of vessel maintenance lay on the proprietor, instead of on the tenant that is if by the contract in using the equipped vessel is transferred to the tenant that is quite widespread by the type of contract called «time charter», the value of the charter market rate is determined with the account the sum of the value of the right–of–use and the present value of vessel maintenance obligations.

The value of the right–of–use in case if obligations of the maintenance lay on the proprietor instead of on the tenant is equal

,

,

where  – the cash flow of operation costs (the annual cost of commercial vessel operation).

– the cash flow of operation costs (the annual cost of commercial vessel operation).

With the account the obligations of vessel maintenance (or other asset) lying on the proprietor the value of the charter market rate  in the sum with the adjustment is determined as:

in the sum with the adjustment is determined as:

, , |

(17.33) |

where,

– is the adjustment with the account the obligations for the commercial vessel charges and maintenance lying on the proprietor and correlated with operation costs to the value of the charter market rate

RN calculated by formulas (17.4–17.17) derived with the assumption that obligations of the maintenance lay on the tenant.

In case of the short interval of the period of use (smaller, than the technological period of maintenance) the determination of the adjustment to the value of the charter market rate

on the basis of the reinvestment account and discount financial functions is inappropriate and the adjustment is equal to the nominal value of operation costs during the payment period for the rent contract.

With a uniform within year and constant cash flow of operation costs

for years if to estimate the short period [

t] between payments by the rent contract in days the adjustment to the value of charter market rate

with the account the obligations for the commercial vessel charges and maintenance lying on the proprietor is

.

In case of a uniform cash flow of operation costs through years

for the option of the commercial vessel or other asset transfer for a long period of use the adjustment

to with the account the obligations of the proprietor determined by the formula is (17.3) equal to the value of the annual charter market rate

, ,

|

(17.34) |

and if the beginning and the end of the period of use, on the one hand, both the beginning and the end of the period of rent charges, on the other hand, accordingly coincide, that is

=

, and

=

, the adjustment

to the value of the annual charter market rate

RN of the payment paid in the advance payment in the beginning of year determined by the formula (17.4) is

. . |

(17.35) |

The general recommendation for determination of adjustment

to the charter market rate

RN estimated for a calendar periodicity of rent charges by each of formulas (17.4–17.17) derived in the assumption that obligations of the maintenance lay on the tenant consists that if in any of these formulas to make a replacement of the symbols:

for

Ń, or

MV for

, – the result will be a corresponding adjustment

to the charter rate with the account the obligations of the proprietor for vessel maintenance (or other asset of the marine company), rather than the charter market rate

RN.

The adjustment

to the value of the annual charter market rate

RN of the payment paid by installments at the end of the year determined by the formula (17.5) is

. . |

(17.36) |

The adjustment

to the value of the charter market rate of advance payment

RN(½), determined by the formula (17.6) paid at the beginning every half a year with the account the obligations of the proprietor is equal

. .

|

(17.37) |

The adjustment

to the value of the charter market rate of payment

RN(½) determined by the formula (17.7) paid by installments at the end of every half a year with the account of the proprietor obligations is equal

. .

|

(17.38) |

The adjustment

to the value of the charter market rate of advance payment

RN(¼), determined by the formula (17.8) paid each quarter at the beginning (that is ¼ part of the year) with the account the obligations of the proprietor makes

. .

|

(17.39) |

The adjustment

to the value of the charter market rate

RN(

t) determined by the formula (17.9) of the advance payment which is done at the beginning of the payment period for any duration of the period (

t/365 of the year where the indicator

t is set in days) with the account the obligations of the proprietor is equal

. .

|

(17.40) |

The adjustment

to the value of the charter market rate

RN(

t) determined by the formula (17.10) of the payment by installments which is done at the end of the payment period (for any duration of the period) with the account the obligations of the proprietor is determined as:

. .

|

(17.41) |

The adjustment

to the value of the charter market rate

RN(¼) determined by the formula (17.11) the payment paid by installments at the end of each quarter with the account obligations of the proprietor is equal

. .

|

(17.42) |

The adjustment

to the value of the charter market rate of the advance payment

RN (1/12) paid at the beginning of each month defined by the formula (17.12) with the account obligations of the proprietor makes

. .

|

(17.43) |

The adjustment

to the value of the charter market rate of the payment

RN(1/12) determined by the formula (17.13) paid by installments at the end of each month taking into account the obligations of the proprietor is equal

. . |

(17.44) |

The adjustment

to the value of the charter market rate of the advance payment

RN (7/365) paid at the beginning every week (that is 7/365 parts of year) determined by the formula (17.14) with the account obligations of the proprietor makes

. .

|

(17.45) |

The adjustment

to the value of the charter market rate of the payment

RN(7/365) determined by the formula (17.15) paid by installments at the end of every week taking into account the obligations of the proprietor is equal

. .

|

(17.46) |

The adjustment

to the value of the charter market rate a day

RN (1/365) determined by formulas (17.16, 17.17) taking into account the obligations of the proprietor is

. .

|

(17.47) |

Test questions

1. Components of the value of the right–of–use if obligations for vessel maintenance lay on the proprietor.

2. Estimation of the adjustment to the charter market rate with the account the present value of the obligations for vessel maintenance.

3. Evaluation of adjustments by the general universal formulas with symbols replacement.

17.5. Estimation of the adjustment to the charter market rate taking into account the requirements of the vessel repayment at the end of the period of use

By the contract of leasing–rent contract with the repayment by the end

of the period of use, when the property rights concerning the vessel (or other asset of the marine company) after of all obligations by the leasing contract are transferred to the tenant, the value of the right–of–use is equal

, if to designate the value at the beginning of the period of use

MV1 =

MV.

The adjustment to the value of the right–of–use with the account the redemption is

.

The value of the annual charter market rate

by the contract of leasing–rent contract with the redemption at the end

of the period of use should be determined with application of adjustment

to the value of the charter market rate

RN calculated by the formulas (17.4–17.17).

The charter market rate

by the contract of leasing–rent contract with the redemption at the end

of the period of use is determined as:

. .

|

(17.48) |

The adjustment

to the value of the annual charter market rate

RN determined by the formula (17.3) with the account the terms of leasing–rent contract with the redemption at the end

of the period of use is equal

, ,

|

(17.49) |

and if the beginning and the end of the period of use, on the one hand, both the beginning and the end of the period of rent charges, on the other hand, accordingly coincide, and if the beginning of the period of use coincides with the time of settlement that is

=

= 0, and

=

, the adjustment

to the value of the annual charter market rate

RN of the payment paid in advance at the beginning of year determined by the formula (17.4) with the account of the terms of leasing–rent contract of the commercial vessel with the redemption at the end

of the period of use is

, čëč , čëč  , ,

|

(17.50) |

with substituting the factor of the fund of compensation

of the value by the end

of the period of use – before the fulfillment of obligations by the leasing contract.

The adjustment

to the charter market rate

RN taking into account the terms of leasing–rent contract with the redemption at the end

of the period of use for corresponding to contract conditions of the rent charges calendar periodicity by formulas (17.19–17.32) if to make replacement of symbols:

for

MV.

The adjustment

to the value of the annual charter market rate

RN of the payment by installments at the end of year determined by the formula (17.5) is equal

. . |

(17.51) |

The adjustment

to the value of the charter market rate of advance payment

RN(½), determined by the formula (17.6) paid at the beginning of every half a year by the terms of leasing–rent contract of the redemption at the end

of the period of use is

. .

|

(17.52) |

The adjustment

to the value of the charter market rate of payment

RN(½) determined by the formula (17.7) paid by installments at the end of every half a year by the terms of leasing–rent contract of the commercial vessel with the redemption at the end

of the period of use is equal

. .

|

(17.53) |

The adjustment

to the value of the charter market rate of advance payment

RN(¼), determined by the formula (17.8) paid at the beginning of each quarter (that is ¼part of year) by the terms of leasing–rent contract with the redemption at the end

of the period of use is

. .

|

(17.54) |

The adjustment

to the value of the charter market rate

RN(

t) of the advance payment which is done at the beginning of the payment period determined by the formula (17.9) for any duration of the period (

t/365 of the year where time index

t is set in days) by the terms of leasing–rent contract with the redemption at the end

of the period of use is equal

. .

|

(17.55) |

The adjustment

to the value of the charter market rate

RN(

t) determined by the formula (17.10) of the payment by installments which is done at the end of payment interval (for any duration of the period) by the terms of leasing–rent contract with the redemption at the end

of the period of use is determined as:

. .

|

(17.56) |

The adjustment

to the value of the charter market rate

RN(¼) determined by the formula (17.11) of the payment by installments at the end of each quarter by the terms of leasing–rent contract with the redemption at the end

of the period of use is equal

. .

|

(17.57) |

The adjustment

to the value of the charter market rate of the advance payment

RN (1/12) paid at the beginning of each month determined by the formula (17.12) by the terms of leasing–rent contract with the redemption at the end

of the period of use is

. .

|

(17.58) |

The adjustment

to the value of the charter market rate of payment

RN(1/12) determined by the formula (17.13) paid by installments at the end of each month by the terms of leasing–rent contract with the redemption at the end

of the period of use is equal

. .

|

(17.59) |

The adjustment

to the value of the charter market rate of the advance payment

RN(7/365) paid at the beginning of every week (that is 7/365 part of thr year) determined by the formula (17.14) by the terms of leasing–rent contract with the redemption at the end

of the period of use is

. .

|

(17.60) |

The adjustment

to the value of the charter market rate of payment

RN(7/365) determined by the formula (17.15) paid by installments at the end of every week by the terms of leasing–rent contract with the redemption at the end

of the period of use is equal

. .

|

(17.61) |

The adjustment

to the value of the charter market rate a day

RN (1/365) determined by formulas (17.16, 17.17) by the terms of leasing–rent contract with the redemption at the end

of the period of use is

. .

|

(17.62) |

As the size of the factor of fund of compensation

, which is a multiplicator in formulas 17.50–17.62 of the adjustment to the value of the charter market rate

RN with the account the terms of leasing–rent contract with the redemption at the end

of the period of vessel use, is little with enough big duration of the period of use, it should be noted that the adjustment

aspires to zero and in case of the big duration of the period of use the value of the market rate for the contract of leasing

differs little from the rate

RN by the contract of rent without the redemption (with identical periodicity of payments).

It should be added that if transfer to rent with the redemption by leasing contract terms is analogue of crediting with the commercial vessel at a security for a debt (or other asset of the marine company) that is if instead of obligations on pledge the borrower sells his vessel in the leasing company and rents the same vessel with conditions of redemption, then among the considered formulas for determination of adjustments (17.50–17.62) those are suitable which take into account the advance payments.

The condition of advance payments should be taken into consideration: the first payment coincides with the time of vessel sale to the leasing company, and the leasing company pays to the tenant for vessel the value minus the first payment that is the guarantee of commercial vessel liquidity by analogy to liquidity of the pledge which value should exceed the mortgage for the value proportional to the resale discount.

If, besides, are provided the payments by equal parts and equal periodicity (that is at the constant rate by the leasing contract), the number of payments in proportion to the number received after dividing of the vessel value (or other asset of the marine company) by the value of the resale discount, and it is also possible to estimate the duration of vessel use before the redemption with the account the number and periodicity of payments.

By the way, if the market rate is determined for the rent contract with the vessel redemption in the specializing leasing company, as well as when the value is determined for the optional variant of the periodic payment for the mortgage (with a vessel as a pledge in case of borrower partial own investments or payment for the mortgage with the commercial vessel as the security of the debt) the discounting rate

i should be accepted according to the estimation of the corresponding organization.

The general recommendations for the determination of the charter market rate value of the right of vessel or other real asset of marine company and the basic steps as sequence of the expert actions are follows:

– Analyze of the data – vessel characteristics (or other asset of the marine company) and terms of the rent contract – obligations of the parties, periodicity of payments;

– Estimate the market value on the basis of standard approaches application;

– Evaluate the right–of–use as difference between present values at the beginning and at the end of the period of use;

– Calculate the charter market rate by the formulas (17.4–17.17) on the basis of equality of the present value of rent charges and the present value of the right–of–use;

– Determine the adjustment to the value of the charter market rate by the formulas (17.19–17.32) with the account the predicted change of the value at the end of the period of use;

– Determine the adjustment to the value of the charter market rate by the formulas (17.34–17.47) with the account the obligations for the maintenance lying on the proprietor;

– Determine the adjustment to the value of the charter market rate by the formulas (17.49–17.62) with the account the redemption of the vessel (or other asset) in the end of the period of use;

– Calculate the charter market rate with the account adjustments by the formulas (17.18, 17.33 and 17.51).

It should be taken into consideration that taxes are a part of the value of the right–of–use, the charter market rate and the adjustments determined by the recommended formulas in the same proportion in which taxes are included into the base market value.

In a more complex task of valuation of the right–of–use when the payments by the rent contract are fulfilled by non–uniform parts, for example when the tenant obligations are divided in parts of investments, if according to the leasing contract the vessel is bought on installment, and the investments into replenishment of working assets – in vessel equipment are fulfilled separately, the fractioning of estimation of the market rate of payments into the separate obligations of the tenant is recommended.

Test questions

1. Leasing is the commercial vessel transfer for use with the redemption.

2. Methodological analogy of leasing, the vessel acquisition (or other asset of the marine company) with payments by installments and the loan.

3. Determination of payments schedule by the contract of leasing–rent contract with the redemption or payments for the mortgage contract (the formula derivation).

4. Valuation of uniform cash flow payment by the contract of leasing (the formula derivation).

5. Determination of payment cash flow by the leasing contract if the beginning of payments period and effective date of estimation coincide (the formula derivation).

6. Conformity of economic terms of the contract of leasing–rent contract with the redemption and the contract of mortgage.

7. Data used for value estimation of the right–of–use as values of rent charges cash flow.

8. Expert tasks that should be solved to determine the conditions of commercial vessel transfer in rent provisions.

9. Recommended sequence in rent charge estimation.

.

![]() ≠

≠![]() , the value of the right–of–use is accordingly equal

, the value of the right–of–use is accordingly equal![]() ,

,![]() =MV, then, with the account used designation, the value of the right–of–use

=MV, then, with the account used designation, the value of the right–of–use ![]() should be determined with adjustment

should be determined with adjustment ![]() , that is

, that is

,

,![]() – the cash flow of operation costs (the annual cost of commercial vessel operation).

– the cash flow of operation costs (the annual cost of commercial vessel operation).![]() in the sum with the adjustment is determined as:

in the sum with the adjustment is determined as: